Market Watch

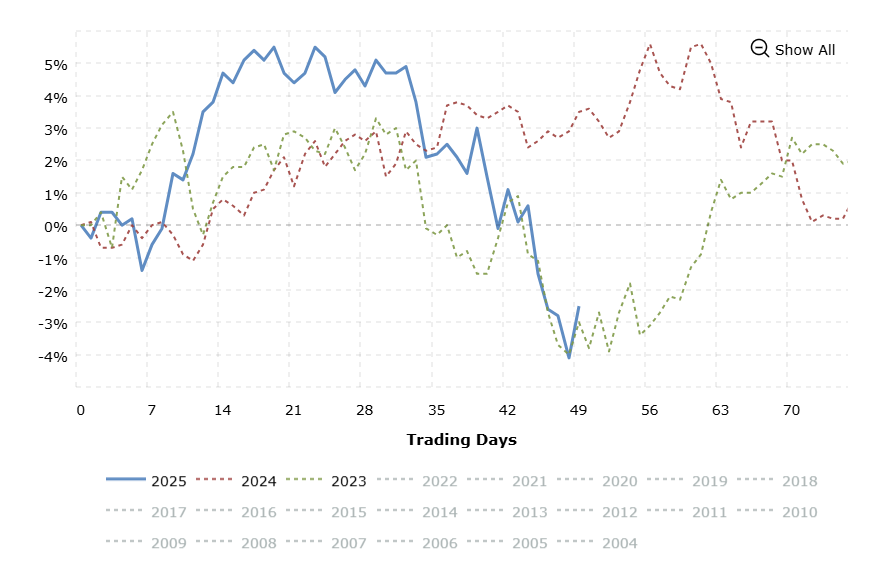

Over the past 30 days, the Dow Jones Industrial Average (DJIA) has experienced notable fluctuations, reflecting a complex interplay of economic factors, policy decisions, and investor sentiment. From February 14 to March 14, 2025, the DJIA declined from 44,546.08 to 41,488.19, representing a decrease of approximately 6.9%. A significant driver of market volatility during this period has been President Donald Trump's aggressive trade policies. On March 13, he announced potential 200% tariffs on European beverage imports if the EU did not lift surcharges on U.S. whiskey. This move heightened fears of inflation and economic slowdown, contributing to the S&P 500 entering correction territory. Despite a rally on March 14, with the DJIA rising by 1.7%, the major indexes closed lower for the week ending March 14. The S&P 500 fell by 2.3%, the DJIA by 3.1%, and the Nasdaq Composite by 2.4%. This marked the fourth consecutive week of losses for Wall Street, underscoring the market's sensitivity to policy-induced uncertainties. Year-to-date, the DJIA has returned -2.7% as of March 14, 2025. This performance is influenced by both domestic policy decisions and international economic developments. Globally, economic indicators have added to market volatility. The UK's unexpected contraction of 0.1% in January 2025, driven by declines in manufacturing and construction, raised concerns about global economic growth. This development, coupled with challenges stemming from Brexit, contributed to market unease. Investor concerns over inflation have been pronounced, especially in light of trade tensions. Speculations about the Federal Reserve's potential monetary policy responses have added to market volatility, as investors weigh the implications of potential interest rate adjustments on corporate earnings and economic growth. Within the DJIA, sector performance has been mixed. Technology stocks, notably Nvidia and Palantir, led a rally on March 14, contributing to the day's positive performance. However, despite this surge, the technology sector has faced challenges amid tariff-induced uncertainties. Looking ahead, the DJIA's trajectory will depend on several factors, including the resolution of trade disputes, clarity on monetary policy, and global economic indicators. Investors will be closely monitoring upcoming economic data releases and corporate earnings reports for insights into the economy's direction. Additionally, geopolitical developments and their impact on international trade will remain key considerations for market participants.